Reminiscences & More

Newsletter Service

From: $22.99 / month

In its 36th year of publication, the Birinyi Newsletter, entitled Reminiscences (in honor of the classic Wall Street chronicle by Edwin Lefevre), remains a popular method of accessing the industry-leading research and analysis provided by Birinyi Associates. Available in two convenient forms of subscription ($225 per year or $22.99 per month), the Newsletter is published monthly and features access to the Birinyi Stock Ratings service (posted weekly on the client portal). The newsletter is sent via email on the last Wednesday of each month, after the market close.

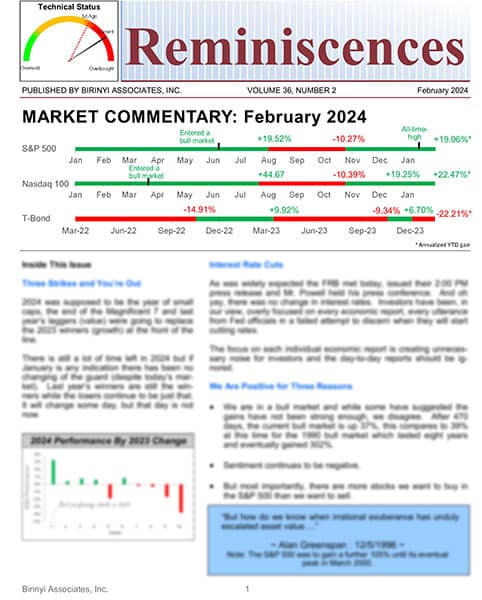

Reminiscences: Now in its 36th year of publication, the monthly newsletter is Birinyi Associates flagship strategy effort. Each month we explore the latest issues confronting the market, offer our views on the direction of the market as well as discuss individual stock and sector recommendations.

Birinyi Stock Ratings: Published every Friday, this interactive database of 1,500 stocks rates the most and least attractive based on a combination of stock research methods. The Ratings also include access to our “Birinyi 50” list of the top rated stocks.

*Please note that Birinyi Associates, Inc. or its principals may already have invested in or may from time to time invest in securities that are recommended or otherwise covered in the Reminiscences Newsletter. Neither Birinyi Associates, Inc. nor its principals intend to disclose the extent of any current holdings or future transactions with respect to any particular security. You should consider this possibility before investing in any security based upon statements and information contained in any newsletter, report or recommendation you receive from us. It should not be assumed that recommendations made will be profitable or equal to the performance of the securities in the portfolio.

The model portfolios are hypothetical portfolios, and you should not assume you will achieve your desired results. Hypothetical trading does not involve financial risk, and no hypothetical trading record can completely account for the impact of financial risk in actual trading. For example, the ability to withstand losses or to adhere to a particular trading program in spite of trading losses are material points which can also adversely affect actual trading results. There are numerous other factors related to the markets in general or to the implementation of any specific trading program which cannot be fully accounted for in the preparation of hypothetical performance results, and all of which can adversely affect actual trading results.

The terms “Conservative”, “Growth” and “Trading” are not meant to imply any degree of risk. All investments involve risk and since no one investment is suitable for all types of investors, it is important to review investment objectives, risk tolerance, tax liability and liquidity needs before choosing a suitable investment. Investing in stocks, bonds, mutual funds, and exchange-traded funds involves potential losses – even the complete loss of your investment.